|

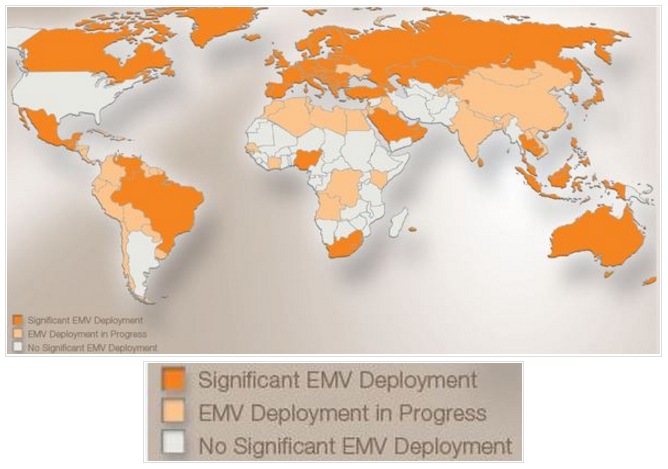

ColorID has been following the recent developments behind EMV (Europay, MasterCard & Visa) migration in the US. Over the past year, American Express, Discover, MasterCard and Visa have announced their plans for moving to an EMV-based payments infrastructure in the U.S. We'll keep you posted on how migrating from our current mag stripe to a contact/contactless payment method will affect you and your cardholders. The following are facts from the timeline and mandates:

Fall of 2011, Visa issued a plan to accelerate the migration to contact chip and contactless EMV chip technology in the U.S. EMV technology will help prepare the U.S. payment infrastructure for the arrival of Near Field Communication (NFC)-based mobile payments by building the necessary infrastructure to accept and process contactless chip transactions. Not only will chip technology accelerate mobile innovations, it is also expected to enhance payment security through the use of dynamic authentication. Chip technology greatly reduces a criminal's ability to use stolen payment card data by introducing dynamic values for each transaction. Even if payment card data is compromised, a counterfeit card would be unusable at the point of sale (POS) without the presence of the card's unique elements. By eliminating static authentication, there is a reduction for the value of stolen cardholder data, benefiting all stakeholders. Visa's plan includes merchant incentives to upgrade to EMV & Contactless chip-enabled terminals, requirements for acquirer processors to support chip acceptance and the introduction of U.S. liability shift policies. As such 3 dates have been set by Visa and they have been backed by MasterCard, American Express and Discover. October 2012: Waive Payment Card Industry Data Security Standard (PCI DSS) compliance validation requirements to encourage merchant investment in contact and contactless chip payment terminals. Will also require acquirer processors to ensure that their systems support dynamic data acceptance (i.e., chip) and will institute a domestic and cross-border counterfeit liability shift. April 2013: Will require U.S. acquirer processors and sub-processor service providers to be able to support merchant acceptance of chip transactions no later than April 1, 2013. This is the only mandate that Visa has introduced into the US market, as Liability shift is not considered a mandate. Chip acceptance will require service providers to be able to carry and process additional data that is included in chip transactions, including the cryptographic message that makes each EMV transaction unique. Will provide additional guidance as part of its bi-annual Business Enhancements Release for acquirer processors to certify that their systems can support EMV contact and contactless chip transactions. October 2015: Plans that effective 1 October 2015, the U.S. will be included in the Global POS Liability Shift Policy, which will apply to all issuers and merchants' acquirers in the U.S., with the exception of transactions at Automated Fuel Dispensers (AFDs). Transactions made at AFDs will be excluded from the liability shift for a period of two (2) years due to the challenges faced by the petroleum industry in upgrading terminals to accept EMV chip cards. Similarly, effective 1 October 2017, transactions made at AFD terminals will be included in the Global POS Liability Shift Policy.

0 Comments

|

Categories

All

Archives

July 2020

|

WE'RE HERE TO HELP.

|

ColorID has spent over 24 years serving the ID Industry with top-level sales and support to build the ultimate trust with every customer.

|

|

|

|