|

Prox card, proxie card, keycard, hid card, smart card, access badge, corporate 1000 card, 26 bit card – whatever you call it, the 125 kHz radio frequency card is still the most widely used card for electronic access in North America. Unfortunately, few people are aware of recent developments that threaten the security status of these familiar cards.

The word “prox” is an abbreviation of “proximity,” which just means “near.” Proximity cards are a significant upgrade for users of mag stripe or Wiegand access cards, which have to be swiped through a reader. Prox cards only need to be held near a reader to open a door, and they work through a wallet, purse, pants pocket or whatever else they are in at the time. Cardholders have enjoyed the convenience of prox cards for nearly three decades. |

|

So you want Mobile ID?

|

The prevailing thought, when it comes to mobile ID, is that the organization has to purchase a complete solution from a single provider. But identity solutions vendor, ColorID, is championing a different perspective for how end users can make the move to mobile.

From ColorID’s point of view, there’s a lot to take into consideration between the day an organization decides to pursue mobile and launch day. Looking at each of these factors, ColorID hopes to offer an alternative to customers interested in issuing mobile IDs to cardholders. ColorID spends considerable time on the road and in web presentations speaking with credential ID issuers of all sizes. One of the common threads across these conversations is mobile ID. CR80News recently spoke with David Stallsmith, Director of Product Management at ColorID, to cover some of the common mobile ID questions he fields from end users, and to hear about ColorID’s efforts around building mobile ID infrastructures for clients. |

Written by: Andrew Hudson

Associate Editor, CR80News.com Published by: AVISIAN, CR80News.com |

What are the primary barriers for customers looking to move to a mobile ID solution?

“In conversations we’ve had with end users over the past 10 years, the most commonly mentioned hurdle in implementing a mobile solution has been cost. For starters, mobile credential providers charge as much or more than cards, for their virtual credentials. Credentials are only keys to the systems they interface with, which likely means upgrades or replacements to infrastructure will be required. Infrastructure poses both financial and business problems for those who want to migrate to mobile. Door readers, electronic locks, points of sale, gates and MFDs must be upgraded, or more likely replaced, in order to read credentials on mobile devices. For some, this could be thousands of reader replacements.”

How can ColorID provide a comprehensive mobile credential solution?

“ColorID has relationships with several manufacturers that offer mobile credentials and the corresponding readers and locks. We’re also working with several software companies as they develop identity management platforms that will include mobile credential lifecycle management. We see the migration to mobile credentials as a longer-term process for most customers. Those that are ready and able can purchase one of the turnkey mobile solutions from the one-card system providers that offer them. For the rest, we’re already providing mobile solutions and helping those upgrade their infrastructures to be mobile-ready.

Mobile ID your way, in your time. That encapsulates the ColorID approach.”

Why should someone consider building a mobile ID infrastructure with ColorID?

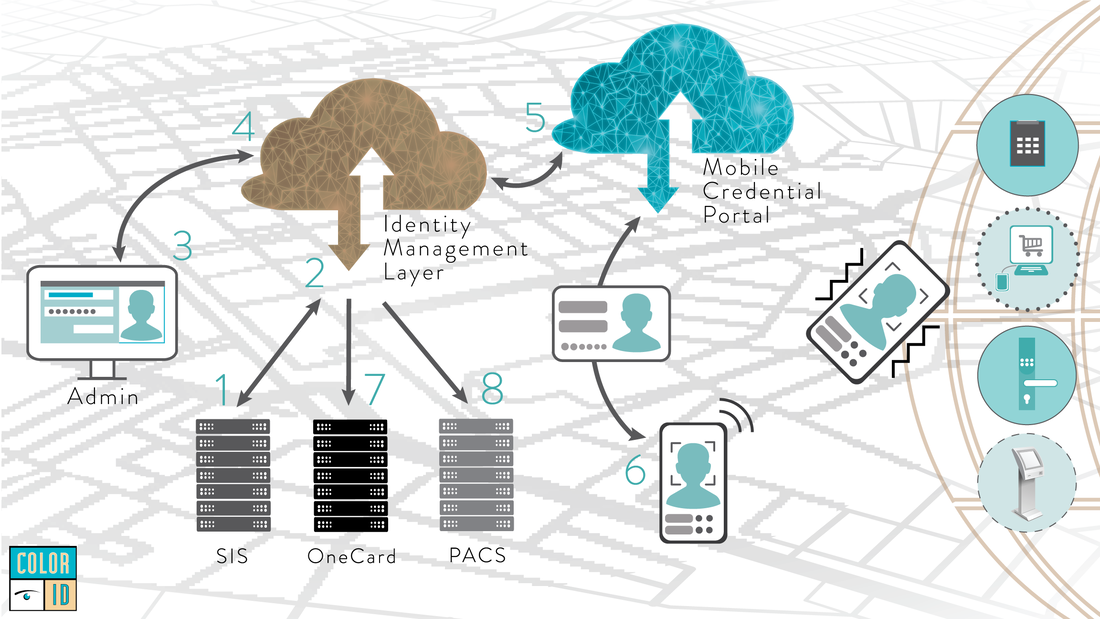

“We’re developing parallel and alternative solutions to those recently introduced by Transact, CBORD and others. Mobile solutions are still new and providers are busy developing a wide range of services that will bring flexibility, security, convenience and, we hope, affordability to this market. One approach we’re offering enables one to issue and manage both cards and mobile credentials as a process separate from the one-card system. In this arrangement, the one-card system becomes the consumer of identity data, rather than its sole manager. For example, many organizations have their own in-house identity management systems that provide these functions. As those systems age and become harder to maintain, we see a need for a modern commercial platform to replace them and bring support for newer systems like mobile ID.”

Does forming a mobile ID infrastructure with ColorID change a credential technology or hardware migration effort?

“We recognize that cards will be with us for a while longer and we will make sure that any mobile product or service we offer will work with existing card systems. In fact, we think our ability to support a wide range of solutions that can coexist with traditional one-card systems provides our customers with the ability to migrate to mobile at their own pace, as their institutional resources allow.”

What specific components is ColorID leveraging to build a mobile ID infrastructure?

“At the simplest level, purchasing and issuing mobile IDs from a manufacturer’s cloud portal such as HID or SafeTrust, and installing compatible readers at doors and POS would get an institution started down the mobile ID path. HID has just introduced Signo, their latest generation of door readers, which are optimized for mobile credentials. SafeTrust, Lenel and many other manufacturers also offer credential, app, and reader combinations. Going up a step, HID SAFE offers mobile ID management in the context of Physical Identity Access Management (PIAM). Several of our other partners are building cloud-based identity management platforms that are tightly integrated with card and mobile issuance systems.”

How should one decide when the time is right to invest in mobile credentials?

“The user experience and mobile ID performance for most enterprises is still taking shape. Widespread adoption, competition resulting in a range of choices and prices, interoperability, and flexibility are all hallmarks of a maturing technology market. I don’t think we’ve seen anything like that yet as it pertains to mobile ID in the US market. Since adoption of mobile ID solutions will be a multi-year process for most who go in that direction, the ongoing introduction of new products and services to support mobile ID implementations are very much in process. End users know where to go to purchase the new, turnkey mobile offerings from Transact, CBORD, Atrium and TouchNet. Other mobile-first systems such as Foundry are also entering the market, which will put pressure on the traditional providers. ColorID is bringing mobile ID and identity management solutions from other providers to market as they become available. Those who are taking more time to implement mobile now will ultimately find more options to select from when they are ready to make decisions down the line.”

Where do you see mobile credentials going forward, both for individual organizations and as an emerging market?

“We believe that a comprehensive identity management platform should be able to provision to any and all systems onsite that consume identity data. That platform should also be capable of managing a range of credential types. Unlike mobile social apps which communicate directly with the cloud, mobile IDs have to interface with a lot of legacy and non-virtual systems. The mobile-reader interface is important, but the identity management platform behind it is vital for a long-lasting, secure, and flexible system. Think about the now very mature ecosystem surrounding credit cards. The background processes involved in vetting you financially, provisioning that card, sending it to you, then recognizing the card at the POS, authorizing it through a real-time account verification, billing you for the transaction through your financial institution, and then reporting all of the above involves a huge number of interconnected systems. Systems that are constantly being updated and/or replaced. Who saw Square coming? We expect similar disruptive introductions to find their way into the market.”

“In conversations we’ve had with end users over the past 10 years, the most commonly mentioned hurdle in implementing a mobile solution has been cost. For starters, mobile credential providers charge as much or more than cards, for their virtual credentials. Credentials are only keys to the systems they interface with, which likely means upgrades or replacements to infrastructure will be required. Infrastructure poses both financial and business problems for those who want to migrate to mobile. Door readers, electronic locks, points of sale, gates and MFDs must be upgraded, or more likely replaced, in order to read credentials on mobile devices. For some, this could be thousands of reader replacements.”

How can ColorID provide a comprehensive mobile credential solution?

“ColorID has relationships with several manufacturers that offer mobile credentials and the corresponding readers and locks. We’re also working with several software companies as they develop identity management platforms that will include mobile credential lifecycle management. We see the migration to mobile credentials as a longer-term process for most customers. Those that are ready and able can purchase one of the turnkey mobile solutions from the one-card system providers that offer them. For the rest, we’re already providing mobile solutions and helping those upgrade their infrastructures to be mobile-ready.

Mobile ID your way, in your time. That encapsulates the ColorID approach.”

Why should someone consider building a mobile ID infrastructure with ColorID?

“We’re developing parallel and alternative solutions to those recently introduced by Transact, CBORD and others. Mobile solutions are still new and providers are busy developing a wide range of services that will bring flexibility, security, convenience and, we hope, affordability to this market. One approach we’re offering enables one to issue and manage both cards and mobile credentials as a process separate from the one-card system. In this arrangement, the one-card system becomes the consumer of identity data, rather than its sole manager. For example, many organizations have their own in-house identity management systems that provide these functions. As those systems age and become harder to maintain, we see a need for a modern commercial platform to replace them and bring support for newer systems like mobile ID.”

Does forming a mobile ID infrastructure with ColorID change a credential technology or hardware migration effort?

“We recognize that cards will be with us for a while longer and we will make sure that any mobile product or service we offer will work with existing card systems. In fact, we think our ability to support a wide range of solutions that can coexist with traditional one-card systems provides our customers with the ability to migrate to mobile at their own pace, as their institutional resources allow.”

What specific components is ColorID leveraging to build a mobile ID infrastructure?

“At the simplest level, purchasing and issuing mobile IDs from a manufacturer’s cloud portal such as HID or SafeTrust, and installing compatible readers at doors and POS would get an institution started down the mobile ID path. HID has just introduced Signo, their latest generation of door readers, which are optimized for mobile credentials. SafeTrust, Lenel and many other manufacturers also offer credential, app, and reader combinations. Going up a step, HID SAFE offers mobile ID management in the context of Physical Identity Access Management (PIAM). Several of our other partners are building cloud-based identity management platforms that are tightly integrated with card and mobile issuance systems.”

How should one decide when the time is right to invest in mobile credentials?

“The user experience and mobile ID performance for most enterprises is still taking shape. Widespread adoption, competition resulting in a range of choices and prices, interoperability, and flexibility are all hallmarks of a maturing technology market. I don’t think we’ve seen anything like that yet as it pertains to mobile ID in the US market. Since adoption of mobile ID solutions will be a multi-year process for most who go in that direction, the ongoing introduction of new products and services to support mobile ID implementations are very much in process. End users know where to go to purchase the new, turnkey mobile offerings from Transact, CBORD, Atrium and TouchNet. Other mobile-first systems such as Foundry are also entering the market, which will put pressure on the traditional providers. ColorID is bringing mobile ID and identity management solutions from other providers to market as they become available. Those who are taking more time to implement mobile now will ultimately find more options to select from when they are ready to make decisions down the line.”

Where do you see mobile credentials going forward, both for individual organizations and as an emerging market?

“We believe that a comprehensive identity management platform should be able to provision to any and all systems onsite that consume identity data. That platform should also be capable of managing a range of credential types. Unlike mobile social apps which communicate directly with the cloud, mobile IDs have to interface with a lot of legacy and non-virtual systems. The mobile-reader interface is important, but the identity management platform behind it is vital for a long-lasting, secure, and flexible system. Think about the now very mature ecosystem surrounding credit cards. The background processes involved in vetting you financially, provisioning that card, sending it to you, then recognizing the card at the POS, authorizing it through a real-time account verification, billing you for the transaction through your financial institution, and then reporting all of the above involves a huge number of interconnected systems. Systems that are constantly being updated and/or replaced. Who saw Square coming? We expect similar disruptive introductions to find their way into the market.”

Interested in talking with a ColorID expert?

|

|

|

|

WE'RE HERE TO HELP.

|

ColorID has spent over 24 years serving the ID Industry with top-level sales and support to build the ultimate trust with every customer.

|

|

|

|

ColorID's interactive e-Binder showcases the full line of products and services needed for your organization's ID needs.

© ColorID, LLC - 2023 | All Rights Reserved